California’s Legislature Takes on Homeownership: An Analysis of 2022 Homeownership Bills (PART I)

In order to shrink the widening racial wealth gap, California must turn around its dismal homeownership rates. In 2019, Black and Latino homeownership rates(2) in California trailed white rates by a shockingly wide margin – 36% and 44%, respectively, compared to 63% for whites.

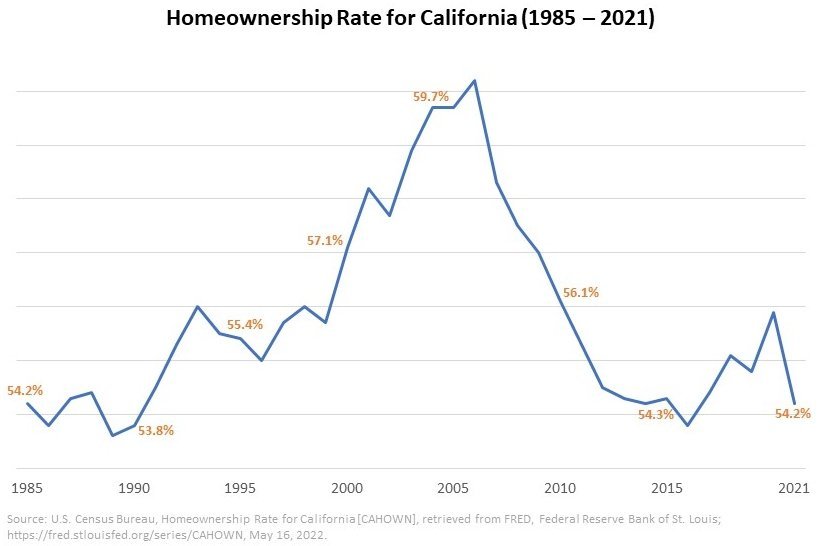

The overall homeownership rate — 54.5% as of 2021 — is down at the same level as it was in the 1980s. Most of the gains made during the 1980s and 1990s — when people of color entered homeownership en masse for the first time — were wiped out in the 2008 Great Recession and have never truly recovered. What recovery did happen at the end of the last decade was lost to COVID.

The one good piece of news in all this is that California’s legislators are paying attention.

At the beginning of the year, Assembly Members Wendy Carrillo and Buffy Wicks held a special committee session in February to explore and understand why California’s homeownership rates are so low, and why this is a racial justice issue. The Little Hoover Commission, California’s in-house think tank, prioritized homeownership issues in its recent set of recommendations for addressing California’s housing crisis. We’ve seen a significant uptick this year in legislation that directly — and sometimes boldly — addresses homeownership issues. To help Californians understand this legislation, we present the following analysis of 2022 bills(3) and budget proposals.

Is 2022 really different?

We believe it is. Below we’ll take a closer look at 14 bills that relate to homeownership. When you include smaller-scope bills which we examine briefly, that makes 20 bills in total that we consider to have something important to say about homeownership(4).

This compares to very few in either the 2017-18 or 2019-20 sessions. Major housing bills, both those that passed and those that did not, were generally quiet on homeownership, and there were fewer bills overall. The 2017 Housing package, for instance, was an important milestone for zoning reform, housing accountability and affordable housing funding. While it did include funding that could be used for homeownership programs, increased homeownership was not a major focus of any of the pieces of the package(5).

This year, we have a range of bills. These include major bills that would create major new statewide programs to address homeownership in new and innovative ways. There are smaller-scope tactical bills which address housing speculators or bad actors seeking to take advantage of an existing homeownership program. Other bills seek to support Community Land Trusts, an important form of homeownership that is growing in popularity across the state. Housing finance bills include specific carve-outs for homeownership, while other measures set new homeownership goals and standards for existing programs. There are study bills that look at important issues in homeownership, like mortgage lending by non-bank lenders, bills that encourage cities to turn blighted property into affordable homeownership opportunities, and bills to offer mortgage help to medical professionals who agree to work in underserved areas. There are bills to make accessory dwelling unit financing easier for homeowners, especially those with lower incomes. There is even a bill to require more fair housing training for realtors — a recognition that changing California’s homeownership rate isn’t just about raising a number, but about raising that number in a healthy, equitable and sustainable way, and not repeating the mistakes of the past. As legislation is a moving target, especially in May, we present the analysis below independent of where each bill is at in the legislative process. Some bills are already ‘dead’ or are unlikely to pass.

In addition to bills large and small, there are also a number of budget proposals from legislators, advocates, and Governor Newsom. Our analysis looks at potential dollars set aside to support homeownership, both on the supply side and the demand side.

Major Bills

One sign that 2022 is different is the number of big vision bills that connect to homeownership. SB 1457 (Hertzberg) is the largest idea and the most directly connected to homeownership(6). It would create a massive $25 billion fund, $18 billion of which would support second mortgages for working Californians as a way to cover the substantial difference between housing costs and what most households can afford, especially when it comes to down payment(7). The remainder would support infrastructure development for new, for-sale housing, as a means of increasing the supply of for-sale homes.

Two other major bills address homeownership and are most notable for including homeownership in policy arenas where it would not have been found in the past. AB 2053 (Lee) would create a California Housing Authority to build mixed-income, cross-subsidized ‘social housing’ in California, with the state taking on a newer and bigger role in the development of housing. Unlike most public housing programs historically, AB 2053 has explicit provisions for limited-equity homeownership(8) as part of the Bill. AB 2011 (Wicks) is the latest zoning reform/ streamlining bill, focused on commercial, office and industrial lands. As part of the affordability requirements needed to trigger the ‘by-right’ development – where developers are not subject to discretionary local project review if they meet certain criteria – developers can build owner-occupied units – with either 30% of the units affordable to moderate income households (80-120% of the area median income) or 15% affordable to lower income households (50-80% of AMI).

SB 1457: California Family Home Construction and Homeownership Bond Act of 2022

Authors: Hertzberg, Caballero, Portantino

Homeownership role: Creates $25 billion bond for November 2022 ballot, including $7 billion for infrastructure and $18 billion for second mortgage down payments.

AB 2053: The Social Housing Act

Authors: Lee, Carrillo, Kalra

Sponsors: East Bay for Everyone, San Jose State University Human Rights Institute, State Building and Construction Trades Council – AFL-CIO, YIMBY Action

Homeownership role: Creates a limited-equity homeownership option for residents of buildings constructed by the proposed California Housing Authority.

AB 2011: Affordable Housing and High Road Jobs Act of 2022.

Authors: Wicks, Bloom, Grayson, Quirk-Silva, Villapudua

Sponsors: CA Conference of Carpenters, California Housing Consortium

Homeownership role: Establishes new by-right zoning in commercial areas with explicit role for Below Market Rate (BMR) homeownership.

Housing Finance

Housing finance is always a key area for housing, and this session features multiple approaches which include homeownership. AB 2560 (Bonta)(9) creates a new financing model for local jurisdictions to turn blighted properties into homeownership opportunities for low- and moderate-income households. SB 490 (Caballero), SB 625 (Limon) and AB 561 (Ting) increase financing programs in different government agencies, the latter focused on ADUs specifically.

SB 1105 (Hueso) and SB 679 (Kamlager) are part of a wave of regional housing finance agency proposals coming in the wake of the successful AB 1487 (2019), which created the Bay Area Housing Finance Agency. The San Diego plan (SB 1105) is the most aggressive when it comes to homeownership, requiring 10-35% of the funds to be used for homeownership – more ambitious than the Bay Area plan, which capped homeownership at 10% of annual funds. The Los Angeles plan (SB 679) allows homeownership but does not require it.

AB 2560: Housing: blighted and tax defaulted property

Author: Bonta

Sponsors: California Community Builders, Richmond Community Foundation, Richmond Neighborhood Housing Services

Homeownership role: Creates new financing models to rehab blighted vacant property into low- and moderate-income homeownership opportunities.

SB 490: Housing acquisition and rehabilitation: technical assistance

Author: Caballero

Sponsors: Enterprise Community Partners, Housing California

Homeownership role: Creates a Housing Acquisition and Rehabilitation Technical Assistance Program at the Housing and Community Development Department for nonprofits and governments, and includes homeownership nonprofits like CLTs and limited-equity co-ops as both subjects and providers of technical assistance.

SB 1105: San Diego Regional Equitable and Environmentally Friendly Affordable Housing Finance Agency

Author: Hueso

Homeownership role: Creates San Diego Regional Equitable and Environmentally Friendly Affordable Housing Finance Agency, with a minimum mandate for homeownership financing.

SB 679: Los Angeles County Affordable Housing Finance Agency

Author: Kamlager

Sponsors: United Way of Greater Los Angeles

Homeownership role: Establishes the Los Angeles County Affordable Housing Solutions Agency (LACAHSA). Homeownership programs are a permitted use.

SB 625: Community development financial institutions: grant program

Authors: Caballero, Limon

Sponsors: California Coalition for Community Investment

Homeownership role: Creates the California Investment and Innovation Program in the California Infrastructure and Economic Development Bank (I-Bank) for Community Development Finance Institutions. Homeownership assistance is an eligible use.

AB 561: Help Homeowners Add New Housing Program: accessory dwelling unit financing

Authors: Ting, Bloom

Sponsors: Bay Area Council

Homeownership role: Requires Treasurer’s office to provide a report to the legislature on how to help homeowners qualify for ADU / JADU loans(10).

Foreclosures

Two key bills work to reform some aspect of the foreclosure process. AB 1837 (Bonta) is a clean-up bill focused on funding for foreclosure prevention that was designed to be used by community land trusts, but which has been abused by fake nonprofits(11). AB 2170 (Grayson) restricts bulk-sales of foreclosures and offers a brief window for tenant and nonprofit purchase in cases where large institutions foreclose on more than 175 properties in a given year.

AB 1837: Residential real property: foreclosure

Author: Bonta

Sponsors: California Community Land Trust Network

Homeownership role: Clean-up bill for SB 107(12) funding process (AB 140, AB 175) which was designed to be used by Community Land Trusts to purchase foreclosed homes with existing low-income homeowners. It has used by shady characters and fake nonprofits to purchase homes. Will ensure that Community Land Trusts will be able to use these funds to prevent displacement of existing owners.

AB 2170: Residential real property: foreclosure sales

Author: Grayson

Sponsors: California Association of Realtors

Homeownership role: Restricts bulk sales of foreclosed properties and offers a tenant or nonprofit owner purchasing window for properties owned by major institutions who foreclose on 175 properties in a given year.

Community Land Trusts

Community Land Trusts are increasingly popular as a way of creating long-term, secure homeownership opportunities, especially — but not exclusively — for lower-income borrowers. In addition to AB 1837 (Bonta) discussed above, AB 2021 (Wicks) makes it possible for CLTs to be included in programs which enable nonprofit housing organizations to purchase and be informed about tax-defaulted properties. AB 1206 (Bennett), a bill from 2021, extends the Welfare Tax Exemption(13) to community land trusts, and allows them to keep the exemption even when occupants’ income goes up to 140% of AMI. Both of these bills elevate CLTs to a similar status in state law as other nonprofit housing developers who build deed-restricted rental housing(14). AB 2710 (Kalra) would create a mandatory right of first offer for tenants whose buildings are put up for sale. Tenants can assign that right to nonprofits, particularly CLTs.

AB 2021: Property tax sales: access to tax-defaulted property information.

Author: Wicks

Homeownership role: Helps CLTs in the tax-defaulted property process.

AB 1206: Property taxation: affordable housing: welfare exemption

Author: Bennett

Sponsors: California CLT Network

Homeownership role: Extends welfare tax exemption to community land trusts, allows them to keep the exemption even when occupants’ income goes up to 140% of AMI.

AB 2710: Residential real property: sale of rental properties: right of first offer

Author: Kalra

Sponsors: Housing California, Public Advocates

Homeownership role: Creates a right of first offer requirement for the majority of rental buildings. Tenants can assign this right to a nonprofit, including CLTs, to negotiate on their behalf. Buildings purchased through this program would be deed-restricted and must be offered by the nonprofits to tenants within 18 months.

Other Bills

These smaller-scope bills from the session are worth noting briefly:

SB 1176 (Limon) would initiate a study to analyze creating a statewide Community Reinvestment Act for California, which would, among other things, enable the state to fill gaps in federal regulation of non-bank mortgage lending(15).

AB 2013 (Quirk-Silva) would add a goal of increasing homeownership by people of color by 20% to the State Housing Plan.

AB 2166 (Mayes) would require 30% of federal Community Development Block Grant and HOME Investment Partnerships Program funds be used for homeownership.

AB 2123 (Villapudua) would provide five-year housing grants for mortgages for health care workers in underserved areas.

AB 919 (Grayson) would change the construction defect laws to make it easier to build condominiums(16).

Budget Proposals

The budget process is another way in which state housing policy impacts homeownership.

In April, a group of 39 legislators, supported by a coalition of housing organizations(17), have asked the governor to include $600 million for homeownership in the May revision of the budget. This would include $400 million for programs to build deed-restricted, below market rate homes, and $200 million for the state’s down payment assistance program. This would be a roughly tenfold increase in funding compared to the January budget proposed by the governor.

The Senate released its budget priorities late April through a document titled “Putting California’s Wealth to Work for a More Equitable Economy.” The Senate document asks the governor to include $2.7 billion for specific affordable housing and homeownership programs. Of this amount, $550 million would be set aside for the CalHome and Downpayment Assistance programs and a $1 billion for a California Dream For All program(18), a new revolving fund for first time homebuyers to partner with the state and purchase homes with low downpayment using shared appreciation mortgages.

The Governor released his proposed budget revision on May 13th. Out of $18.5 billion for housing and homeless funding, about $3.7 billion is set aside to support homeownership, primary in the form of single family home mortgage lending ($2 billion) and a Homeowner Assistance Fund made possible through the American Rescue Plan Act ($1 billion).

Building on 2022

It’s hard to pass good housing bills in California, and CCB appreciates the work that all legislators are doing to try and address homeownership. Whether or not any of the above bills pass — both the big dreams and the smaller fixes — it will be critical to maintain the momentum from this session.

Even if bills do pass, and we have new programs and new resources to make a dent in who owns California, turning around this ship and building sustainable and equitable homeownership for communities of color in California will require significant effort over the long term. Creation of a homeownership master plan had originally been proposed by Assemblymember Quirk-Silva, and there is significant room for additional big vision work. Key issues like condo defect legislation remain stubbornly hard to change. It’s very hard to build condos in California right now, creating barriers to homeownership for younger buyers, and those with smaller families or lower incomes.

California Community Builders is committed to addressing California’s racial wealth gap, and to rebuilding homeownership across the state. Stay tuned for future briefs and reports on the need for a Community Reinvestment Act for California, on barriers to multi-family homeownership, and much more.

—

This policy brief was prepared by Schafran Strategies on behalf of, and in collaboration with, California Community Builders. We welcome feedback on our publications and invite readers to reach out to Adam Briones (abriones@ccbuilders.org) to share your perspective.

Note: This analysis focuses on all bills introduced in the California State Legislature during the 2021-22 session which include substantial focus on homeownership or a policy area connected to homeownership. California Community Builders has taken positions on some of these bills, and we indicate that support via a footnote as appropriate.

2 Data on Asian homeownership typically combines all Asian nationalities into one misleading lump, obscuring major differences between Asian communities in homeownership as well as wealth and income.

3 This document is intended to outline and summarize current homeownership efforts in the California Legislature and is not meant to be a guide to legislation CCB supports or opposes.

4 We analyze all bills that would have a meaningful impact on some aspect of homeownership, regardless of current status. Bills which reference California’s low homeownership rate in the preamble, and then do nothing specific to change that number, are not included.

5 The 2017 package’s SB2 and SB3 did have important funding mechanisms. Some of the zoning reform bills, like AB 73, could potentially help new multi-family homeownership opportunities, but AB 73 has largely not been used. We will explore these possibilities in a forthcoming report on multifamily homeownership.

6 CCB was selected by the State Treasurer’s Office, as a part of a larger team, to research and design a potential shared appreciation mortgage program. The report we deliver may inform future iterations of SB 1457, with specifics to be decided in the future by the author’s office.

7 The program would essentially lend buyers a significant portion of the down payment.

8 Limited-equity homeownership, shared-equity homeownership, and Below Market Rate (BMR) homeownership are different names which generally refer to an overlapping suite of different housing tenures in which ownership operates in collaboration with a non-profit organization, and where sale prices are limited to maintain long-term affordability. Limited-equity cooperatives are one common form, where owners own a share in the housing cooperative which owns the building. Community Land Trusts and Habitat for Humanity houses are other common forms of this type of homeownership.

9 CCB is a co-sponsor of this bill.

10 JADU, or junior ADUs, are accessory dwelling units build into the original building, as opposed to stand alone structures. A basement or attached garage conversion are common types of JADUs.

11 CCB has signed on in support of this bill.

12 See note 8.

13 The Welfare Tax Exemption is a property tax exemption for certain types of landowners, generally charities and religious institutions. It has traditionally been applied in California to non-profit landlords of deed-restricted buildings whose tenants earn less than 80% of Area Median Income, but has not extended to CLTs.

14 Deed restrictions are legally binding obligations that are attached to property and impact what current and future owners can do with the property. Income restrictions are a common form of deed restriction for affordable housing, as it obligates the property to be owned or rented by someone at a set income level.

15 This will be the subject of an upcoming policy brief.

16 Construction defect rules determine the legal liability of builders for construction defects. This particularly impacts for-sale housing, as builders can be sued by new owners.

17 Assemblymember Tim Grayson and Senator Anna Caballero are leading the legislative request on behalf of their respective houses. The organizations officially supporting this request include Habitat for Humanity, which is leading the effort, the California Building Industry Association, the California Association of Realtors, CA YIMBY, Mighty Buildings, Casita Coalition, Greenbelt Alliance, Housing Action Coalition, The Two Hundred, the California Hispanic Chamber of Commerce, and California Community Builders.

18 California Community Builders is a member of the team selected by the State Treasurer’s Office to help design the CA Dream for All program.